“It’s time for the United States to return to the system that made us richer and more powerful than ever before…1870-1913…Instead of taxing our citizens to enrich foreign nations, we should be taxing foreign nations to enrich our citizens.”

– President Trump, January 27, 2025

Tariffs are the tip of a very large iceberg

One hundred twenty years ago, before the IRS existed, tariffs were an important source of revenue to the US government. Donald Trump says he wants to bring those days back. But 100 years ago, we didn’t have huge debts and mandatory entitlements that required huge revenue and spending. So, it’s completely unrealistic to imagine our government can eliminate domestic taxes in lieu of tariffs. On this issue, Trump is clearly grandstanding or pandering to the ignorant.

Trump keeps saying that foreigners will pay these tariffs, but this claim is misleading at best. In a typical tariff arrangement, it’s the importer who writes the tariff check to the government. A tariff is simply a tax paid by the importer of foreign goods. To take a real-world example, if John Deere sells a $100,000 tractor made in Illinois to a Chinese farm equipment dealer, the Chinese dealer pays John Deere $100,000 and then must pay a 10% tax ($10,000) to the Chinese government before he can sell the tractor.

However, prices are dynamic and will adjust along the sales chain. So, both the exporter and importer may reduce their profit margins to make the post-tariff sales price competitive.

Whatever the price dynamics turn out to be, in virtually all cases, a tariff will increase the price and lower the volume purchased by consumers. So, you could compare tariffs to a sales tax, or value-added tax. From the maker to the final consumer, everyone along the value chain ultimately gets less than they did before the tariff. Only the government gets more money. And productivity suffers due to higher costs.

Those are the basic economic facts of tariffs, but as we will soon see, there may be other non-economic reasons to impose them. In fact, most of today’s tariff debate is a shiny object that is distracting us from a much bigger and more important issue, of which tariffs are only one piece. Intentional or not, Trump’s tariff talk is a decoy diverting our attention from the bigger picture.

And many, if not most, pundits are taking the bait. They claim the Trump agenda is “chaotic.” They see daily news as a blizzard of disorganized activity with no conscious endgame. But these people are naively mistaken, likely influenced by some variant of the TDS mind virus, which prevents you from seeing past Trump’s rude, often offensive, exterior.

The Trump agenda is anything but chaotic. On the contrary, it is a highly integrated, though still incomplete, plan. My theme today is that tariffs are a very visible part of a comprehensive economic strategy that is gradually unfolding before us. This emerging strategy is much more important than the specific issue of tariffs.

To see the big picture, you must look through Trump’s unorthodox methods and bombastic personality. So today, we are going to look underneath the water line at the rest of the iceberg. Hopefully, this discussion will give you a framework to understand the daily blizzard of incoming news from the Trump camp.

Before we get in deep, I want to clarify my position: today, I’m here as an observer and analyst, not as a champion of the Trump agenda. I don’t subscribe to every element of the Trump-Bessent strategy. However, as investors, it’s essential to regard Trump’s unfolding policies as facts of nature, much like an unexpected twist of fate that we must adapt to. Think of this discussion as a foundation for building a sturdy house that can withstand unpredictable changes in the weather. We may not see eye to eye with these policies, but they are coming. As investors, we need to adapt.

A New World Order

To understand the Trump-Bessent plan, it’s necessary to grasp how Donald Trump, Treasury Secretary Scott Bessent, and most of Trump’s other cabinet members and advisors see the world. What’s emerging is a plan designed to embrace what they see as an inevitable new world order – a blend of international and domestic political and economic conditions that require a specific policy response. The two main challenges are:

First, the unpayable US government debt, including our unfunded future obligations, amounts to a present value of at least 150 trillion dollars. As regular podcast listeners and readers of my book know, US government obligations, as presently stated, can never be paid in dollars of current value. in my book, A Black Hole in Economics, I have cited the US’s unpayable future entitlement obligations as today’s number one economic problem. This is now common knowledge, and the problem is front and center in the minds of both investors and politicians, even though most politicians are still afraid to talk about it. Trump and Bessent know it as well as anyone else. The US’s unpayable sovereign debt and the chronic deficit spending required to fund it are the main economic problems that must be addressed.

The second major challenge is declining globalism, which has two facets: China’s growing military and economic power and the USA’s diminishing ability to be the sole policeman of the world’s conflicts. Hand in hand with declining globalism is our new and growing cold war with China, Russia, and Iran. These growing tensions and threats require a shift in the international trading system away from open world trade and toward regional and strategic trade agreements that are joined at the hip with national security concerns.

These two problems—the United States’s debt problem and a shifting balance of military power—are closely related. To put it concretely, our debt and deficits have made it impossible for us to remain the world’s sole superpower or policeman. Simply put, if you can no longer borrow during a war, you are going to lose that war.

In other words, domestic economics and international politics have now converged into a singularity – one big, intertwined problem for the President of the United States.

I wrote in Black Hole that the most logical and politically acceptable way for our politicians to deal with their debt and deficits is through a policy of financial repression – a combination of low real interest rates and moderately high inflation. This policy gradually pays down the debt in depreciating dollars, but it also drains the real wealth of the average productive worker, especially the traditional savers and the productive middle class.

This is important, because this Administration has built its political support on a promise to not burden the middle class with the government’s financial problems. As we’ll see, the Trump-Bessent Plan is an attempt to implement policies that will attack the debt and national security problems without burdening the Trump voter base.

To understand the plan now unfolding, I want to zero in on the man at the center of making it happen – Treasury Secretary Scott Bessent.

Bessent is a hedge fund founder who became a billionaire by understanding geopolitical events – including international economic events, demographic trends, capital flows and currency price movements – and investing and trading based on this knowledge. He is soft-spoken, almost anti-Trump in personality, and perhaps this is one reason Trump chose him as a salesman for his economic plan.

Bessent is a strategic thinker, in sharp contrast to his predecessor, Janet Yellen, who was an exemplary technocrat. Yellen proved she knew how to find the money in the Treasury’s bilge decks and move it around to keep the ship’s hull balanced, but as far as I know, she had zero strategic vision.

Bessent is much different. In a November 2024 interview with the Manhattan Institute, Bessent laid out his worldview. He said he is alarmed by the size and scope of US debt and spending, which he views it as dangerous and untenable. Then he added this:

We’re also at a unique moment geopolitically, and I could see in the next few years that we are going to have to have some kind of grand global economic reordering, something on the equivalent of a new Bretton Woods or if you want to go back, like something back to the Treaty of Versailles. There’s a very good chance that we are going to have to have that over the next four years, and I’d like to be a part of it.[1]

Bessent is explicit in his belief that 1) the deficits and spending must be reined in; 2) that the world is in a unique moment politically that will require a new monetary order; and 3) he wants the policies he adopts to be good for Main Street people and businesses, not just Wall Street. On the last point, here is what Bessent said at his confirmation hearing:

One of the things that, as someone who came from a very small town, lived in New York with a very big town and came back to a small town, I believe Wall Street has done great the past few years and that Main Street has suffered. I think it’s Main Street’s time. Wall Street can continue to do well, maybe not as well, and it’s time to have a Main Street, small-business-led recovery led by small banks, regional banks, as I call it, reprivatizing the economy. And as I said earlier, since November 15th, since President Trump’s election, we have seen the biggest jump in the history of the Small Business Confidence Index. [2]

Furthermore, Bessent firmly believes Trump understands and shares this worldview. As Bessent said in a September 2024 interview on Fox News, “Economic policy and national security are inseparable.”

Stephen Miran’s influence

Bessent, in turn, is influenced by the writing and thinking of Trump’s National Security Advisor, Stephen Miran, who also believes we are on the cusp of generational change in our international financial and trading systems. Miran formerly served under Treasury Secretary Steve Mnuchin in the first Trump term. He is a successful academic economist and hedge fund operator. Miran has written an influential 40-page thesis called A Users Guide to Restructuring the Global Trading System. This piece is the talk of the financial world, currently being circulated and discussed in all the professional investment journals.

Some pundits are even calling the plan spelled out in this document the “Mar-a-Lago Accord,” named after the president’s Florida estate, in the same vein that other famous international financial agreements have been named after the hotel or resort or hotel where they were agreed, like the Bretton Woods Agreement or the Plaza Accords.

But in reality, there is no such thing as the “Mar-a-Lago Accord,” at least not yet. So far, this is just a popular codename for an emerging strategy that is not fully formed and has not been signed by anyone. So we should take these ideas seriously, but not yet literally, as they are likely to change as more parties get on board.

In a February Bloomberg article on the so-called “Mar-a-Lago Accord,” Wall Street economist Jim Bianco made the point that the dire state of our national debt and national security requires radical thinking, a new approach rather than continuing the status quo. I agree, and it’s clear to me that Trump and Bessent are definitely thinking outside the box. The previous administration seemed not to even notice the problems. [3]

(To highlight the seriousness of both Bessent and Miran compared to the flippancy of the Biden administration, I have footnoted a link to an interview with Jaren Bernstein, the former chair of the President’s Council of Economic Advisors under Joe Biden. The video outs Bernstein, a music major with a master’s degree in sociology, as a moronic economic illiterate. Bernstein was the head of the same advisory body once chaired by Alan Greenspan. If you want to see an example of gross ignorance and incompetence in a public official, which was all too common in the Biden Administration, don’t miss this 2-minute video.[4])

Back to Scott Bessent. The Treasury Secretary Bessent has concretized his vision in a “3-3-3 Plan.” Let Bessent speak for himself:

“…I might advise him [Trump] to campaign on the “three arrows.” 3% real economic growth and how do you get that? Through deregulation, more US energy production, slaying inflation, forward guidance on confidence for people to make money so the private sector can take over from the bloated government spending. Two, I would urge him to make public his desire to get the deficit down to 3% [of GDP] by the end of his term….I think they averaged 4% under him [Trump]. Get that down to 3%. And three million more barrels equivalent a day from US energy production. That would be my 3-3-3.” [5]

The pending minerals and oil deal with Ukraine is an example of how they will connect economic policy with national security policy. Under this deal, Ukraine gives the US first right to purchase fossil fuels and minerals. This is partly to pay back the US for the tens of billions spent on the war and partly as a security agreement. US commercial business assets in Ukraine would be a soft deterrent against Russian aggression and would also help Ukraine recover economically. The question of Ukraine joining NATO would be off the table. The military guarantee, if any, would be provided by European countries, in part by beefing up Poland’s defenses. So, Poland’s border would become a NATO hard line, but the NATO treaty would not expand, which might satisfy Russia.

Here’s Bessent in an interview with the Financial Times, wrapping the Ukraine agreement in the box labeled both “Economics” and “Security”:

“The President recognizes that national security is built alongside economic security, and the more successful and secure postwar Ukraine is, the more that both the Ukrainian people and the people of the US will benefit. This economic partnership would lay the foundations for a durable peace by sending a clear signal to the American people, the people of Ukraine, and the government of Russia about the importance of Ukraine’s future sovereignty and success of the US.” [6]

Main Elements of the grand strategy

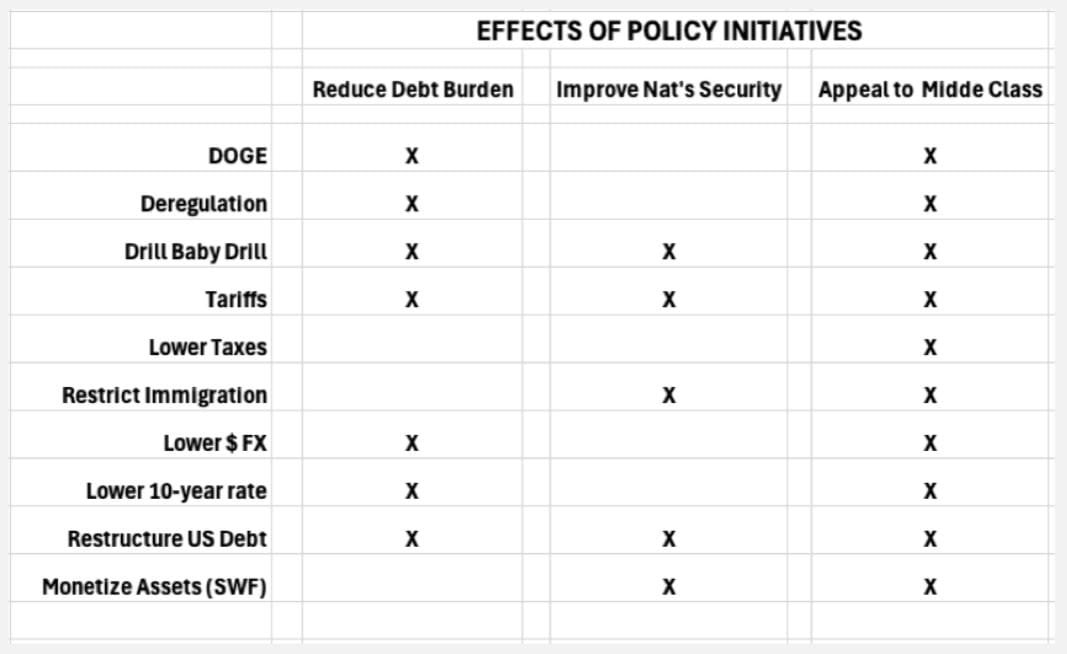

To see how the Trump-Bessent grand strategy might unfold on multiple fronts, we need to look at Trump’s campaign promises and Bessent’s 3-3-3 plan to see how they will address these combined economic and security goals.

So let’s now look at some of the key Trump-Bessent initiatives to see how they can pull these policy levers to control spending while also boosting national security. Note also that each policy initiative is designed to appeal to the Trump voter base, the middle class, providing either a real or a perceived benefit.

Policy No. 1: DOGE

The DOGE investigation has revealed shocking levels of fraud and misuse of funds, such as USAID’s undisclosed funding of media hostile to Donald Trump, and green energy boondoggles galore. Then there is the discovery of over 390 million active social security numbers, despite the fact that there are only 340 million U.S. citizens, implying a potential for massive fraud at worst or incompetence at best. The list of DOGE discoveries grows daily.

What does DOGE actually accomplish? First, it finds wasted spending – low-hanging rotten fruit that will be eliminated. However, I doubt they will find $1 trillion of fraud and waste. In my view, DOGE’s real value lies in its message: a commitment to transparency and accountability that resonates with the public and embarrasses the political opposition. This is both good politics and a good start to better thinking about government spending.

Policy No. 2: Deregulation

Both Trump and Bessent strongly believe that deregulation – not just in energy, but across all industries – will spur entrepreneurial growth more than anything else they can do. This will help grow GDP and the tax base, helping to pay down debt. Trump is already eliminating regulations by executive order, just as he did in his first term, but at a faster pace. They base this belief on their own experience: Trump as a developer, Bessent as an investor who researches entrepreneurial activity. “We have to re-privatize the economy,” said Bessent on Fox Business News in September 2024. “We are not France.[7]

Watch the federal register as one indication of deregulation. Expect more deregulation this term due to the efforts of DOGE and the legal fallout from the Supreme Court’s 2024 Chevron Deference ruling.

Policy No. 3: Drill baby drill

Deregulation and expansion of energy production gets its own category because energy production is not only an engine of economic growth, but also a major strategic asset for national security. Bessent believes lower energy prices will help keep consumer prices low, partially offsetting the higher prices caused by tariffs on imports, and helping to lower interest rates. Energy exports will also help our balance of payments, resulting in lower trade deficits with trading partners. Energy dominance can also be a powerful political weapon against China, Russia, and Iran.

Policy No. 4: Tariffs

In Bessent’s view, tariffs have three roles in the Trump strategy:

First, tariffs are a negotiating tool for more favorable trading arrangements for American businesses. Improving these terms of trade means more production and prosperity for Americans. Adverse trading practices employed by our trading partners include both tariffs and non-tariff barriers like sales taxes on imports, currency manipulation by central banks, state-subsidized financing for exporters, lawsuits against competing American companies, and restrictions or fines levied against US tech companies.

Under the reciprocal tariff concept, Bessent said,

“We are just doing what they are doing…if they remediate [these policies], then tariffs could drop. If they want to continue these unfair trading practices, then the tariff wall will go up until they are willing to negotiate. I am sure that he [Trump] is willing to do whatever it takes to get free but fair trade for the American people.”[8]

Tariffs could also be used to negotiate better security arrangements. The USA might say to NATO: pay your fair share of defense costs, or we will raise tariffs.

Second, tariffs are a revenue source for government. Tariffs will no doubt enhance government revenue to some extent. Because a tariff is paid by the importer, it may feel less offensive than an income tax, which taxes the bottom line, and it sounds better than a “sales tax.” But in fact, a tariff is a sales tax levied on an importer, just as state sales taxes are levied against retail merchants in the USA.

Third, tariffs are seen as a protectionist tool to encourage production to shift to the USA. “Protectionism” is considered unfair and inefficient under a free market, but it is also seen as an important security measure by the US Department of Defense, which has been saying for years that we are dependent on China for the very same goods we would need to fight a war against them. In other words, according to some Pentagon officials, we have been borrowing money from China (as when they lend to us by purchasing Treasury bonds) in order to buy Chinese components to build the weapons we need to face down China’s military. We literally cannot fight a war against China without Chinese factories. From a national security point of view, that is not a great position to be in. Tariffs against China will be one important tool to rectify this problem by moving critical military industries back to the USA.

Viewed this way, the status quo trading system is a national security threat. Another Bessent quote:

“What are we trying to do? We are trying to make China rebalance. China over-manufactures and they deprive the household sector. They under-consume. If you push them to rebalance, then the identity of that is more US manufacturing.” [9]

So we might tariff Chinese drones and certain computer chips, making them so expensive they will be re-sourced from a maker in the USA or at least from a friendlier nation, preferably in the Western Hemisphere.

Policy No. 5: Lower taxes

Both Bessent and Trump agree that lower income taxes will free up investment capital and promote faster economic growth. They believe the historical lessons of the Laffer Curve, which implies that the government will bring in more revenue by keeping taxes low, deregulating the economy, and growing the tax base than by simply raising taxes. Especially deadly, in their view, are increased capital gains taxes and, worst of all, a wealth tax. We will not see these under Trump.

Policy No. 6: Restricting Immigration

Both Trump and Bessent want to crack down on illegal immigration. Bessent sees the illegal problem as a drain on the Treasury because most illegals do not work until several years after arriving, so they must be fed and housed. According to Bessent, millions of illegals also increase the housing shortage, driving shelter costs higher. He has analysis to justify this conclusion.

Trump also sees illegal immigration as a national security threat, as he emphasizes the criminal and potential terrorist implications of uncontrolled immigration, as well as the trade in deadly drugs like Fentanyl, which kills tens of thousands of Americans every year.

Trump also says illegals “steal” American jobs, which seems to contradict the view that jobs create economic growth. Trump would restrict immigration to “the best people,” i.e., those who can add the most to economic production right away while not taking good jobs from American citizens. His widely publicized “gold card,” which allows a foreign investor to buy a green card for if he pays $5 million and creates 10 US jobs, is emblematic of this “allow only the best” policy.

Perhaps Trump’s greatest fear is that millions of illegals will join the left-wing voting bloc, undermining the Trump-Bessent to privatize the economy and resurrect the middle class.

Policy No. 7: A lower dollar exchange rate

President Trump has repeatedly discussed adopting substantial changes to dollar policy. Trump and Bessent want to bring the dollar exchange rate down to encourage US domestic industry, increase export industries, grow the nominal GDP, and thus grow the tax base. Stephen Miran provides some detail in his paper:

Sweeping tariffs and a shift away from strong dollar policy can have some of the broadest ramifications for any policies in decades, fundamentally reshaping the global trade and financial systems.

Consensus on Wall Street is that there is no unilateral approach that the Trump Administration can take for strengthening undervalued currencies…this conclusion is wrong. There is a variety of steps an Administration can take if it is willing t be creative, that do not rely on the Fed cutting rates. [10]

Policy No. 8: Lower interest rates

“He [Trump] and I are focused on the 10-year Treasury,” Bessent said in an interview with Fox Business. When asked about whether President Donald Trump wants lower interest rates, Bessent said: “He is not calling for the Fed to lower rates.”[11]

Why does Bessent focus on the 10-year Treasury rate? Because a low 10-year rate will not only help keep Treasury interest costs down, but also influences other key rates, as the 10-year is a bellwether rate that affects mortgage rates, corporate bond rates, and the overall cost of capital when calculating investment returns.

Although he would like to avoid forcing rates down, Bessent may still need to resort to suppressing interest rates, which has been done before in the US and many other countries. I outlined various ways the government can suppress interest rates in Chapter Seven of Black Hole.[12]

For the near term the trend seems to be in the Administration’s favor. DOGE is helping to build confidence in the Treasury market. And Bessent has noticed: “Interest rates are down on the ten-year for five weeks in a row since President Trump took office,” he told Maria Bartiromo of Fox News on February 23. Whether rates are down due to DOGE or other reasons is unknown at this point.

One big task for Bessent is to refinance about $8 trillion in US Treasury debt this year. He needs lower interest rates to keep down overall interest costs. For the time being, Bessent must continue selective issuance along the entire yield curve, issuing lots of T-bills like Janet Yellen did.[13]

Policy No. 9: Restructuring US Debt

Over the last 6 months, it has been speculated and discussed by numerous Trump policymakers (Bessent and Miran before they were in the Trump Administration as well as by various economists) that one game plan the US could follow to deal with its acute debt problem is by forcing US allies to swap their Treasury bills for longer-term Treasury bonds. To compensate them for the loss of liquidity, the Fed would lend against these bonds at their full par value (i.e., create new money) no matter what happens to the market price. This is similar to the kind of money-printing bailout the Fed provided to Silicon Valley Bank in March of 2023

In an extreme variation of this idea currently making the rounds, the US would swap a 50 or even 100-year zero coupon bond worth trillions for an equal face value of Treasury bonds owned by NATO countries. By eliminating coupon payments, this would drastically reduce US interest costs. In return, the Fed would give NATO countries a line of credit to borrow against the new zero coupon bonds, as described above. This kind of deal would allow the NATO countries to convert their zero-coupon bond to cash when they needed liquidity without having to sell their Treasuries into a volatile bond market.

This scenario would make Europe, not Main Street America, pay for the US debt. Would it work? The effect could be dramatic if it does: You could basically eliminate several trillion in Treasury debt in exchange for a security guarantee and a financial guarantee of liquidity on demand from the Fed. You could even argue this would enable the survival of the EU and its currency, dependent as both are on NATO protection.

While this proposal is extreme and unlikely to happen, it’s helpful to consider it because extreme problems, like the current level of US debt, require extreme solutions. At root, it is just another clever way to alleviate debt by printing new money, which will inevitably be part of a long-term solution.[14]

Policy No. 10: Monetize US assets, possibly through a sovereign wealth fund.

When Trump signed the EO establishing the SWF, Bessent said this:

“We are going to stand this thing up within the next 12 months. We are going to monetize the asset side of the US balance sheet for the American people. We are going to put those assets to work, and I think it’s going to be very exciting…It will be a combination of liquid assets, assets that we have in this country.” [15]

A sovereign wealth fund is a government-owned investment fund aimed at offsetting government costs by generating revenue. It could achieve this through strategic asset purchases like TikTok, leveraging confiscated assets such as Bitcoin (BTC), earning income from leases and royalties on mineral rights, and selling government-owned real estate. Additionally, the fund could monetize the Treasury’s gold reserves, which total 8,133 metric tons currently valued at $42 per ounce on the books, even though gold’s market price is over $3,000 per ounce. This significant asset could help address budgetary concerns and potentially boost gold prices.

To be clear, a sovereign wealth fund—a large pool of investment assets owned and managed by the government rather than private enterprise—is a very bad idea, but it may still happen.

***

So that is a survey of ten announced strategies that all fit into this Trump-Bessent grand plan, which has two main goals: restoring sound finances to the Treasury and negotiating security agreements to protect Americans under the new geopolitical order. Most importantly, they will not do all these things on the backs of the American middle class.

Historically, sovereign debts have been paid off by the working middle class because that is where the real wealth and productivity are. Financial historian Russell Napier recounts how the UK paid down its World War II debt over 35 years on the backs of British shopkeepers and savers. Napier defines “financial repression” as “stealing old people’s money slowly” by undermining both the value of savings and the ability of the middle class to save.[16]

But the Trump-Bessent plan is adamantly opposed to plundering the middle class. They do not want the mechanic from Oshkosh or the retiree from Oklahoma to pay for the government’s past sins. As they see it, the American taxpayer has been funding the world’s police force – the US military, especially in NATO – for many decades. In their view, Europe is free-riding, i.e., paying too little. A German worker can wake up, spend the day in a coffee house complaining about America, and then go to sleep under the American defense umbrella, secure in the fact that the American taxpayer is paying for this privilege. Trump and Bessent are saying: no more, not this time, not on the backs of hard-working Americans.

Here is Bessent again:

“I think it’s Main Street’s time. Wall Street can continue to do well, maybe not as well, and it’s time to have a Main Street small business-led recovery, led by small banks, regional banks,” Bessent said at his confirmation hearing.[17]

This message appeals to the Trump/Vance political base who believe they elected Trump to change the system that has hollowed out jobs, stagnated real wages, and transferred hundreds of billions of new claims on wealth to Wall Street through a stock market bubble.

Some of these stereotypes and claims are true, and some are not, but all of them are popular with the Trump voter base.

As the tariff policies are announced, the stock market has been swooning and selling off. Wall Street and media pundits are panicking, with many speculating that a stock market disruption will kill support for Trump’s plan. I believe this is incorrect. To determine if Trump will stick to his plan, don’t look at the stock market, look at Trump’s approval ratings.

Trump’s voters are not the elite. They are not big stock owners, so they don’t care about stocks. They want lower mortgage rates, an affordable home, lower inflation, and a paycheck that pays for the groceries. As we write this, Trump’s approval ratings, though down somewhat since the election, are still higher than his highest rating during his first term.

So, I suspect the unfolding Trump-Bessent plan will continue to get voter support. What exactly will it look like? We don’t know. Will it accomplish all its objectives? We don’t know.

However, the urgency of the national debt, combined with a clear need for a revised national security arrangement, provides an opportunity for comprehensive change. That is the organizing principle behind Trump’s outwardly chaotic actions. Both Trump and Bessent see this opportunity, and they are embracing it with a bold solution.

Will they still have to resort to financial repression in some form to address the debt? I believe they will, as the debt and entitlements problem is huge and very long-term. Randall Forsyth of Barrons agrees. A recent headline read: “Bessent’s Plan for Cutting Debt Isn’t Enough. He May Need a Good Dose of Repression.” [18] As outlined in Black Hole, I think we will ultimately see some financial repression techniques implemented. However, Trump and Bessent will try to soften the blow by growing the economy and making our trading and security partners share the economic burdens of both trade and security.

In Chapter Seven of Black Hole,I tried to get creative by suggesting, per Sun Tzu’s advice in The Art of War, that you must “become your enemy.” This means we must think like our money-hungry politicians to anticipate their next moves, which will be key to determining capital flows and asset prices.

But, admittedly, I underestimated the creativity of Donald Trump and his crew. In the first few weeks of his administration, they’ve rolled out some new ideas that I didn’t see coming. Although I don’t approve of all these policies, all of them should be understood as attempts to solve the debt problem, enhance national security, or both.

So, let’s stay tuned and alert. In future essays and podcasts, I will return to this theme to see how the Trump-Bessent team is faring.

Resources for Further Study

A Black Hole in Economics: Money Creation and its Consequences

Finally, if you haven’t already, don’t forget to check out my book, A Black Hole in Economics: Money Creation and its Consequences. If you like it, please write a few lines in Amazon reviews, which only takes a couple of minutes.

Loco-FocoPress.com

I would like to highlight the new website of my publisher, Loco-Foco Press. Loco-Fofo is owned and operated by friend and colleague Brad Thompson, a tenured professor of history at Clemson University. Brad publishes and writes excellent books, plus a regular Substack called The Redneck Intellectual, in which he analyzes American culture, with an emphasis on education. Check out his Stack, which is both provocative and entertaining. Brad Thompson is definitely one of the good guys.

Download Bonus PDF

PDF contains a link to Scott Bessent’s bio, interviews, and essays, as well as some comments on his firm, Key Square Capital Management, that will provide additional color. I recommend these if you want to understand better how Bessent frames economic trends and international relationships.

“The Fallacy of Bidenomics: a Return to Central Planning”

Highlights of the Bessent essay in the FT:

- The Obama administration featured a return to heavy government intervention in the private sector, particularly through its turbocharged expansion of the regulatory state, delivering an economic constipation similar to that which plagued the U.S. before the Reagan revolution.

- At its core, Bidenomics represents a return to the discredited economic philosophy of central planning.

- Like all prior attempts at central planning, it failed to deliver prosperity, and instead generated a substantial upward price-level shock, accompanied by an insidiously persistent inflationary environment that has eroded standards of living in the United States. Continual economic anxiety has replaced abundance and prosperity.

- Economic policy must construct the proper policy mix for the economy as it exists to deliver the economy as you wish it would be.

- History teaches us that prioritizing free enterprise and limiting government’s role in the economy are key to raising living standards. Private sector innovation and risk-taking are the United States’ greatest assets. U.S. economic policy must cast aside the latest failed central planning experiment of Bidenomics and reorient back towards private sector led innovation and growth. The solutions are known: slay inflation, achieve energy dominance, execute meaningful deregulation, control federal spending, reorder unsatisfactory trade arrangements, reassert control on immigration, and project strength internationally.

How do we make money with this information? Diversify some of your savings into gold, Buy gold regularly with part of your periodic savings. The West (US and Europe) doesn’t get it yet, but we eventually will . So far, only Asian investors (Chinese, Indians) get it, despite the fact that the gold price in dollars is up almost 40% in the past year. If you haven’t started your regular gold savings program, consider starting it now.

Bessent Interview at Manhattan Institute Free Market Conference, June 6, 2024

Keysquarecapital.com

In chess, particularly in endgames, a “key square” (also known as a critical square) is a square such that if a player’s king can occupy it, he can force some gain such as the promotion of a pawn or the capture of an opponent’s pawn. Key squares are useful mostly in endgames involving only kings and pawns.

Bessent understands that entitlements must eventually be addressed, just not yet:

“These entitlements are massive. I think that the next four years isn’t the time to deal with them. We’ve got to deal with the discretionary portion of the budget and get that under control. But I think the signal – I always say crawl, walk, run. We’ve got to crawl, maybe walk our way to get the current deficits under control and then the next steps is for the future administration to have the confidence to deal with the entitlements.”

References

[1] Scott Bessent, 6/6/24, via Manhattan Institute

[2] Scott Bessent confirmation hearing, January 16, 2025

[3] https://www.bloomberg.com/news/articles/2025-02-20/-mar-a-lago-accord-chatter-is-getting-wall-street-s-attention?embedded-checkout=true&sref=dJHrNkep

[4] https://www.youtube.com/watch?v=1Fj0zRmEWYc

[5] Sept 12, 2024, interview with Manhattan Institute https://archive.org/details/CSPAN3_20240913_030900_Key_Square_Group_Investment_Firm_CEO_at_Free_Market_Conference/start/1920/end/1980 In this interview, Bessent readily acknowledges that the long-term problem of entitlements must be addressed, but thinks now is not the time. His job is to pave the way for this under the next administration.

[6] Scott Bessent, Financial Times op-ed, February 22, 2025 https://www.ft.com/content/91a727ff-ddde-4973-abc3-2b0ea2de6cf7?shareType=nongift

[7] https://www.msn.com/en-us/news/politics/trump-laid-out-a-definitive-vision-scott-bessent/vi-AA1q5hy8

[8] Bessent on a Fox News interview with Maria Bartiromo, February 23, 2025.

[9] Scott Bessent, 10/17/24, via Simplify Asset Management

[10] Stephen Miran, A User’s Guide to Restructuring the Global Trading System, November 2024

[11] 2/5/25 Bessent, Trump Focus on 10-Year Yields, Not Fed Short-Term Rate – Bloomberg https://www.bloomberg.com/news/articles/2025-02-05/bessent-says-he-trump-focus-on-10-year-yields-not-pushing-fed?sref=dJHrNkep

[12] See Chapter Seven, “The Arsonist and the Firemen,” A Black Hole in Economics: Money Creation and its Consequences.

[13] https://www.reuters.com/markets/us/bessents-focus-10-year-us-treasury-yield-may-let-fed-off-hook-2025-02-06/

[14] Helpful article on “Mar-a-Lago”: https://www.ft.com/content/1e19165e-1096-4aad-bf08-42132f7a3239

[15] Scott Bessent, Oval Office, February 10, 2025 Reuters: https://www.reuters.com/markets/wealth/trump-signs-executive-order-create-sovereign-wealth-fund-2025-02-03/

[16] A Black Hole in Economics: Money Creation and its Consequences, page 167.

[17] https://www.marketwatch.com/livecoverage/treasury-secretary-confirmation-hearing-scott-bessent/card/-wall-street-can-continue-to-do-well-maybe-not-as-well-bessent-says-b3cN1omEA9uW4dEjJRKt

[18] https://www.barrons.com/articles/bessent-rates-debt-doge-repression-340c96b1