Here’s what the 1936 government pamphlet on Social Security said: “After the first 3 years — that is to say, beginning in 1940 — you will pay, and your employer will pay, 1.5 cents for each dollar you earn, up to $3,000 a year. … Beginning in 1943, you will pay 2 cents, and so will your employer, for every dollar you earn for the next 3 years. … And finally, beginning in 1949, 12 years from now, you and your employer will each pay 3 cents on each dollar you earn, up to $3,000 a year.”

Here’s Congress’ lying promise: “That is the most you will ever pay.”

Having read the government pamphlet, I consulted Webster’s Dictionary. The definition for the word ever contains descriptions like: “at all times,” “always” and “at any time.” Had Congress lived up to its promise, our maximum Social Security tax this year would be $90 instead of over $6,000. The Social Security Act of 1935 would have never been enacted had Americans back then known that we’d be subject to a $6,000 tax.

Another lie in the Social Security pamphlet is, “Beginning Nov. 24, 1936, the United States government will set up a Social Security account for you. … The checks will come to you as a right.” Americans were led to believe Social Security was like a retirement account and money placed in it was our property. President Clinton, Vice President Gore and their sycophants want you to continue to believe that. The fact of the matter is you have no property right whatsoever to your Social Security “contributions.”

You say, “Williams, that’s crazy; what do you mean?”

In a U.S. Supreme Court case, Helvering vs. Davis (1937), the Court held that Social Security was not an insurance program, saying, “The proceeds of both employee and employer taxes are to be paid into the treasury like any other internal revenue generally, and are not earmarked in anyway.”

In another Supreme Court case, Fleming vs. Nestor (1960), the Court said, “To engraft upon Social Security system a concept of ‘accrued property rights’ would deprive it of the flexibility and boldness in adjustment to ever-changing conditions which it demands.” Again, the Court rejected any comparison of Social Security with insurance or an annuity.

Now the Social Security Administration belatedly is trying to clean up its history of deception. Its web site (www.ssa.gov/history/nestor.html) says, “Entitlement to Social Security benefits is not (a) contractual right.” Adding, “There has been a temptation throughout the program’s history for some people to suppose that their FICA payroll taxes entitle them to a benefit in a legal, contractual sense. Congress clearly had no such limitation in mind when crafting the law.” That’s Social Security Administration’s dishonest blame evasion. After all, it was they who said, “The checks will come to you as a right.”

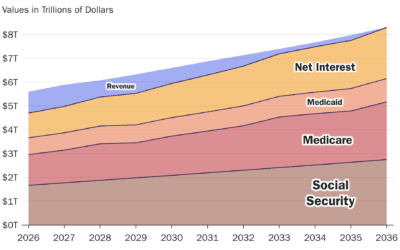

What to do? First, let’s commend George Bush for having the guts to touch the “third rail” of American politics by warning the American people that Social Security is a national disaster waiting to happen in just 20 or 30 years. His proposal to allow workers to take two or three percent of their FICA taxes and invest them in an approved private investment vehicle is a good first step.

A bolder step would be to honor our current Social Security obligations and allow any person who chooses to do so to opt out of the program altogether and privately manage their retirement needs. That, of course, would retire funding Social Security obligations out of general revenues for a period, requiring large spending cuts elsewhere. But each year we’d be moving toward a permanent solution.