Private enterprise built America’s Motor City; government destroyed it.

Money & Banking

Understanding Gold Market Dynamics

To an extent that reveals a thorough misunderstanding of the market forces, the financial media has failed to consider the different motivations and beliefs that drive the different types of investors who are active in the gold market. By treating the gold market as...

The Great Reflation

This week economists, investors and politicians were treated to some of the "best" home price data since the frothy days of 2006 when home loans were given out like cotton candy and condo flipping was a national pastime. The Case-Shiller 20 City Composite Home...

The Biggest Loser Wins

While the world's economies jockey one another for the lead in the currency devaluation derby, it's worth considering the value of the prize they are seeking. They believe a weak currency opens the door to trade dominance, by allowing manufacturers to undercut foreign...

Gold Recovers Amidst Uncertainty

The selloff in gold that captured the world's attention in mid-April has revealed some truths about how the market trades and the sentiments of many of the investors who have piled into the trade over the past few years. While the correction does highlight a higher...

Business Hero John Allison: BB&T — The Bank That Atlas Built

Ayn Rand asked the question, “Philosophy: who needs it”? Allison and BB&T have proven that businesses need philosophy — Ayn Rand’s philosophy.

Gold in the Crosshairs

In the opening years of the last decade, most mainstream investors sat on the sidelines while "tin hat" goldbugs rode the bull market from below $300 to just over $1,000 per ounce. But following the 2008 financial crisis, when gold held up better than stocks during...

Can It Happen Here? Cyprus Government Confiscates Cash From Private Bank Accounts

After going back and forth, the government of Cyprus ultimately decided, under international pressure, to go ahead with its plan to raid people’s bank accounts. But could similar policies be imposed in other countries, including the United States?

Gentlemen, Start Your Presses: The Bernanke Virus Spreads Across the World

The past few months illustrate a serious spread of Bernanke’s policies across the entire developed world.

Ben’s Balance Sheet Blues

The Fed has no credible exit strategy.

FED’s Tightening Pipe Dream

There is no exit strategy because the results of the Fed withdrawing its artificial support would be disastrous for the US Treasury and in the short-term, the US economy.

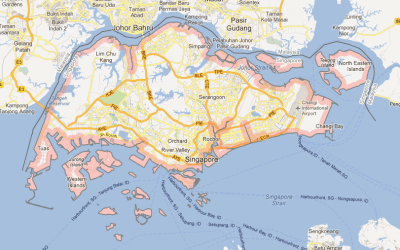

Singapore A Wise Owl Among Currency Snakes

Currency devaluation is not a winning strategy, especially for a country with a strong balance sheet.

The Trillion Dollar Trick

The birth, and the apparent death, of the trillion dollar platinum coin idea may one day be recalled as a mere footnote in the current debt crisis drama. The ultimate rejection of the idea (which was to use a loophole in commemorative coinage law to mint a platinum...

Inflation Propaganda Exposed

Economists who hold the popular view that expanding the money supply will provide the best medicine for our ailing economy dismiss the inflationary concerns of monetary hawks, like me, by pointing to the supposedly low inflation that has occurred during the current...

A Bank CEO’s Advice to Congress

With the “fiscal cliff” mess not solved but merely kicked down the road a few months, it’s a good time to summarize a few points I make in my book, The Financial Crisis and the Free Market Cure. I hope – but do not expect – that our elected representatives learn to...

No Way Out

By upping the ante once again in its gamble to revive the lethargic economy through monetary action, the Federal Reserve's Open Market Committee is now compelling the rest of us to buy into a game that we may not be able to afford. At his press conference this week,...

Fedophilia: Irrational Adoration of the Federal Reserve System

Although the movement to “End the Fed” has a considerable popular following, only a very tiny number of economists—our illustrious contributors amongst them—take the possibility seriously. For the rest, the Federal Reserve System is, not an ideal currency system to be...

Central Banks Hedge Their Bets

Gold appears to be headed for an impressive price appreciation for the second half of 2012. Since the beginning of July, gold is up almost 10 over the same time frame. What is noteworthy here is that in recent months, fears of a worldwide recession have increased...

Inflation: Washington is Blind to Main Street’s Biggest Concern

Journalists, politicians and economists all seem to agree that the biggest economic issue currently worrying voters is unemployment. It follows then that most believe that the deciding factor in the presidential race will be the ability of each candidate to convince...

Intermediate Spending Booms

A number of recent exchanges between Market Monetarists and their critics, and especially those of their critics associated with the Austrian school, have debated the contribution of excessively easy Fed policy toward the housing boom and bust. The issue boils down to...

Banks Punished For Central Bank and Political Errors

In recent decades politicians have increasingly followed the Keynesian prescription of economic growth through continued government borrowing and the creation of undreamt of amounts of fiat money by central banks. To facilitate this process, the larger commercial...

Gold Still Glitters

Just a few weeks ago, Mario Draghi, President of the European Central Bank (ECB), announced that he would do anything required to bailout the weakest members of the Eurozone and in so doing prevent the euro currency from dissolution. Investors who may have been...

Free Banking vs Banking Panics

In the 19th century America experienced one banking "panic" after another: 1819, 1837, 1857, 1873 and 1893. These recurring "panics" allegedly proved what happens in a completely unregulated banking system, a banking system free from the enlightened supervision of the...

Operation Screw

With yesterday's Fed decision and press conference, Chairman Ben Bernanke finally and decisively laid his cards on the table. And confirming what I have been saying for many years, all he was holding was more of the same snake oil and bluster. Going further than he...

Subscribe for free.

Latest pro-Capitalism goodness sent weekly to your email box.

No spam. Unsubscribe anytime.