All that glitters is not gold.

John Browne

What’s in the Vault?

Many have understandably sensed that central banks may well have acted to allow bullion banks to take out massive naked short positions in precious metals in order to drive down the price.

Understanding Gold Market Dynamics

To an extent that reveals a thorough misunderstanding of the market forces, the financial media has failed to consider the different motivations and beliefs that drive the different types of investors who are active in the gold market. By treating the gold market as...

Germany Under Pressure To Create Money

Currently, central banks around the world are walking in lock step down a dangerous path of money creation. Led by the Federal Reserve and the Bank of Japan, economic policy is driven by the idea that printed money can be the true basis of growth. The result is an...

Gold Recovers Amidst Uncertainty

The selloff in gold that captured the world's attention in mid-April has revealed some truths about how the market trades and the sentiments of many of the investors who have piled into the trade over the past few years. While the correction does highlight a higher...

Cypriot Chaos Assists EU Centralization

Remarks by members of the European Union's elite suggesting that banking deposit seizures may become standard practice appear to have heightened the risk of a European bank run and perhaps even a catastrophic collapse of the euro. Any threat to the euro is a threat to...

Gentlemen, Start Your Presses: The Bernanke Virus Spreads Across the World

The past few months illustrate a serious spread of Bernanke’s policies across the entire developed world.

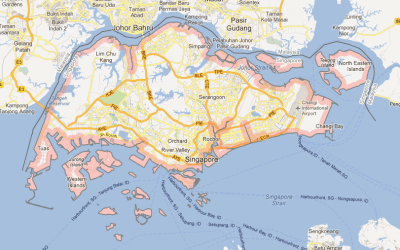

Singapore A Wise Owl Among Currency Snakes

Currency devaluation is not a winning strategy, especially for a country with a strong balance sheet.

EU Financial Tax Portends Loss of Market Leadership

Although it was barely noticed by the American press, on January 22nd, EU finance ministers approved a new "Financial Transactions Tax" (FTT) that has implications for market competitiveness around the world. The move was conceived as a Franco-German initiative and...

German Gold Claw Back Causes Concern

Last week the Bundesbank (the German central bank) surprised markets around the world by announcing that it will repatriate a sizable portion of its gold bullion reserves held in France and the United States. To many, the news from the world's second largest holder of...

France and the UK Could Be the Lynchpins of Europe

Over the past two months, Europe's problems seem to have disappeared from the headlines. However, the new French Socialist government is pushing ahead with policies that favor significantly higher government spending, greater regulation of business and commerce, and...

Central Banks Hedge Their Bets

Gold appears to be headed for an impressive price appreciation for the second half of 2012. Since the beginning of July, gold is up almost 10 over the same time frame. What is noteworthy here is that in recent months, fears of a worldwide recession have increased...

Banks Punished For Central Bank and Political Errors

In recent decades politicians have increasingly followed the Keynesian prescription of economic growth through continued government borrowing and the creation of undreamt of amounts of fiat money by central banks. To facilitate this process, the larger commercial...

Gold Still Glitters

Just a few weeks ago, Mario Draghi, President of the European Central Bank (ECB), announced that he would do anything required to bailout the weakest members of the Eurozone and in so doing prevent the euro currency from dissolution. Investors who may have been...

Dependence Day

The Fourth of July week brought unwelcome birthday gifts to the United States in the form of poor domestic jobs data and similarly gloomy information from other major economies. Amidst the heat and festivities, it has become difficult to deny that the economy is...

Germany Loses to Italy, Again

Poll after poll makes it perfectly clear that the German people have no interest in exposing their hard-earned savings to the ravages of unending bailouts and currency debasement.

European Leaders Play With Fire

The world economy today stands at the doorstep of great change. A gathering crisis looms in Europe, splitting the Continent into two competing blocs. While leaders there face off against one another in a high stakes game of chicken, the rest of the world powerlessly...

Germany Faces Political Isolation

One month ago it appeared that Germany held the whip hand in its titanic struggle against those seeking to cure all economic ills with the snake oil of currency debasement. Now, it appears that the ground beneath its feet is being swept away in a flood of popular...

Germany’s Mixed Signals

Last week's media headlines focused on how the election results in France and Greece reflected a wave of rising public resistance across Europe to the austerity programs being championed by Germany, the IMF, and the EU. Less notice has been given to Germany's internal...

Austerity Fires Voter Vengeance Against Euro

Though there can be little doubt the euro would survive without the Greeks or the Spanish, there is greater doubt of the euro surviving without the Germans solidly behind it. As the world’s second largest reserve currency, the collapse of the euro would precipitate a major international monetary crisis.

BRICS Summit: Brazil, Russia, India, China, and South Africa

Last week, the leaders of Brazil, Russia, India, China, and South Africa met in New Delhi for their fourth annual "BRICS" summit. The meeting brought together five countries that together represent 43 percent of the world's population and 18 percent of the world's...

Subscribe for free.

Latest pro-Capitalism goodness sent weekly to your email box.

No spam. Unsubscribe anytime.