For thousands of years, gold and silver have served that purpose. They remain the best long-term protection I know of against the erosion of fiat money’s value. But before you buy gold, it’s critical to remember that no investment is risk-free.

In this essay, I’ll walk through the three real risks of owning gold: theft, government action, and price volatility. And I will show why understanding these risks actually strengthens the case for owning gold, not weakens it.

1. The Risk of Theft — and How to Minimize It

Gold is physical. That’s both its strength and one of its few vulnerabilities.

Unlike digital assets or bank accounts, gold can’t be hacked or inflated away. But that also means you must store it responsibly.

For small investors, this is straightforward. A modest amount of bullion or coins can be stored discreetly at home—a locked drawer or small safe. As holdings grow, so should your precautions. Safe-deposit boxes at reputable banks work well for moderate amounts. Bonded, insured depositories—such as the Texas Bullion Depository near Austin—offer Fort Knox–level security for larger holdings. There are at least a dozen major private vaults across the U.S., all with insured, audited systems and restricted access protocols.

The truth is, actual theft losses from professional depositories are exceedingly rare. With basic prudence and some common sense, theft becomes more of an inconvenience than a real financial threat.

Digital assets, on the other hand, face an entirely different danger: fidelity risk—the risk of fraud, cyber theft, or institutional failure. Physical gold avoids all that. It exists outside the financial system, immune to bank collapses or data breaches.

So yes, gold can be stolen—but with proper storage, the practical risk is very low.

2. The Risk of Government Confiscation — Why It’s Highly Unlikely Today

This is the question I get more than any other:

“Could the government take our gold again?”

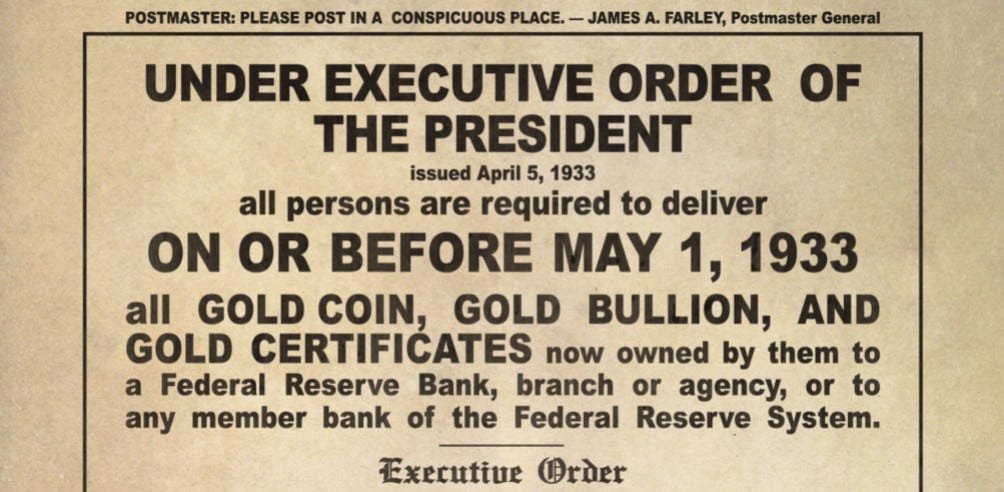

It’s a fair question. After all, it has happened before—under President Franklin D. Roosevelt in 1933.

That year, through Executive Order 6102, Americans were ordered to turn in their gold coins, bullion, and certificates to the Federal Reserve in exchange for $20.67 per ounce. Noncompliance could mean ten years in prison and a $10,000 fine—about $240,000 in today’s money.

The legal justification came from the 1911 Trading with the Enemy Act, amended by the Emergency Banking Act, giving the president sweeping powers during a declared national emergency.

In 1934, the Gold Reserve Act went further: it required the Federal Reserve to transfer its gold to the U.S. Treasury and prohibited private ownership of bullion.

Importantly, this wasn’t outright theft—citizens were paid for their gold.

But a year later, the official price was raised to $35 per ounce, devaluing the dollar and defaulting on the US Government’s fixed-price promise.

From 1933 to 1974, private ownership of gold bullion in the U.S. remained illegal. But the tide eventually turned.

The Restoration of Gold Ownership

- 1971: President Nixon ended the convertibility of dollars into gold for foreign governments, severing the last link between the dollar and the metal.

- 1974: President Ford rescinded FDR’s ban. Congress passed Public Law 93-373, legalizing private gold ownership with an overwhelming bipartisan majority (381–33 in the House).

- 1977: Public Law 95-147 removed the president’s authority to regulate gold except in declared war.

- 1985: The Gold Bullion Coin Act authorized the minting of American Gold Eagles—the first legal U.S. bullion coins in over fifty years.

(For details, watch the video below.)

These laws didn’t just re-legalize gold ownership—they codified it as a permanent property right. Reversing that today would be politically suicidal and economically catastrophic.

Why Modern Confiscation Is Unlikely

- Legal obstacles: Gold ownership is now protected by law, not by mere executive order.

- State-level resistance:

46 states have removed sales tax on bullion.

13 have declared gold and silver legal tender.

States like Texas, Utah, and Wyoming actively promote gold reserves and reject central-bank digital currencies. - Public sentiment: Gold ownership today is mainstream and bipartisan. Any attempt to outlaw it would meet massive legal and political resistance.

Could confiscation technically happen again? In theory, yes. But it would require a declared war and a level of overreach well beyond modern precedent. In practice, the government has far easier ways to erode your wealth—through inflation, taxation, and fiscal policy.

3. The Risk of Price Volatility

Gold’s third major risk is the most obvious one: price fluctuations.

Like any asset, gold can rise or fall sharply in dollar terms. Buy at a short-term peak, and you might lose value if forced to sell soon after. But over the long run, gold’s record is one of remarkable resilience.

Since 1971, the “post-gold” era, gold and the S&P 500 have both delivered strong returns—but at different times. This non-correlation is gold’s great advantage: when stocks crash, gold often holds—or climbs. When inflation spikes, gold tends to surge.

And when both move down together, gold tempers the losses.

The 30-Year Test

From 1995–2025, I modeled three portfolios:

- 100 % gold, earning 3 % annual interest paid in gold (available today through select lease programs).

- 100 % S&P 500, with dividends reinvested.

- A 50 / 50 mix of both.

(Please see the attached video for the detailed analysis.)

The results were nearly identical in total return—around 11 % annualized—but the blended portfolio experienced far less volatility.

- During the dot-com crash (2000-2002), stocks fell 38 % while gold rose 3 %.

- During the financial crisis (2008), stocks fell 37 % while gold rose 19 %.

- In 2022, when both declined, gold’s losses were roughly half those of equities.

A recent article in the Financial Times confirms my experiment. The combination of stocks and gold offered smoother growth with less stress.

“Looking at the past six instances where the S&P 500 fell 15 % or more, gold initially declined as well. But by the time the S&P bottomed, gold had outperformed by an average of 40 percentage points.”

— Financial Times, October 22, 2025

When panic hits, gold may wobble temporarily—but it doesn’t break.

The Risks You Don’t Take by Owning Gold

Every investment carries risk. Gold is unique in the risks it does not take.

“What makes gold compelling,” wrote Michael Weeks of Edelweiss Holdings, “are the risks we don’t take by owning it.” No forecasting or guesswork is required. The risks we don’t take owning gold could fill volumes. With gold, there is no duration risk, credit risk, or liquidity risk. The metal is not moved by financial instability nor threatened by national insolvency or chaos in foreign exchange markets. There are no margin calls and no refinancing risk. There is no risk of technological obsolescence, depletion, depreciation or decay, nor does it require cheap energy, cheap credit or cheap trade to remain viable. It doesn’t care about your national energy policy or who you buy your gas from or how many pipelines are running. You don’t have to keep the lights on or even keep it warm. There are no financial accounts to pore over, no balance sheet to blow up, no cash flows to dwindle, no stale inventory and no margin pressures in difficult times. There are no key man or supplier risks, no competitive risks, no management to squander its future. Gold does not depend on the character, skill or enthusiasm of anyone. It doesn’t require the faith or good will of others. It doesn’t require you to trust anyone at all.”

As investor James Aitken once said, there are three choices in markets: buy, sell, or do nothing. During times of financial stress, gold allows that third option—the freedom to wait.

That’s why I encourage every saver to own some physical gold. Store it safely. Forget it exists. And rest easier knowing no politician or policy can make it vanish. If a bad financial storm comes, it’s there for your use.

Most people will not do this, but I believe many will wish they had.

Beyond Storage: Earning Interest on Gold

Today, through companies like Monetary Metals and Co., it’s possible to earn interest on gold paid in gold. Structured leases and bonds offer around 4 % annual yield while keeping your holdings fully allocated and physical.

Full disclosure: I serve on the board of Monetary Metals and am both an investor and a client. But even if I weren’t, I’d still use them. The ability to grow your gold without converting to fiat is, in my view, one of the most promising financial innovations of this century.

If you understand the three real risks of owning gold—theft, government, and price volatility—you can plan intelligently around them.

Gold’s risks are different, not greater, than those of stocks and bonds. Because they move independently, gold actually reduces your overall exposure to systemic risk.

So yes—own gold. But do it wisely, with your eyes open and your mind calm.

The goal isn’t to get rich overnight; it’s to stay solvent, sane, and sovereign in a world that’s forgotten what money really is.